Feb 14, 2025

Maximizing Your Trading Strategy: Insights into the Stock Market

In the dynamic world of trading, understanding the stock market is crucial for success. This blog explores key strategies and insights shared in a recent live session, providing valuable tips for traders looking to enhance their approach to trading.

Table of Contents

- 📈 Introduction to Trading

- 🎯 Setting Targets in Trading

- 📊 Understanding Chart Trends

- 💬 User Feedback and Confidence Building

- 📅 Market Updates and Predictions

- 🤖 Utilizing AI in Trading Strategies

- 📊 Key Indicators for Trading

- 🗣 Language and Communication in Trading

- 🛢️ Crude Oil Trading Insights

- 📐 The Importance of Angles in Trading

- 🏦 Focus Areas in Trading: Mid Cap, Nifty, Bank Nifty

- ❓ FAQ: Common Questions about Trading

📈 Introduction to Trading

Trading in the stock market can be both exhilarating and daunting. It involves buying and selling financial instruments, such as stocks, bonds, and derivatives, with the aim of making a profit. Understanding the basics is essential for anyone looking to navigate this fast-paced environment.

Traders must familiarize themselves with various terms, strategies, and market dynamics. The stock market operates on the principle of supply and demand, where prices fluctuate based on investor sentiment and market conditions. A solid grasp of trading concepts can significantly improve your chances of success.

Key Components of Trading

- Market Types: Familiarize yourself with different markets, including equities, forex, and commodities.

- Trading Styles: Understand various styles, such as day trading, swing trading, and long-term investing.

- Risk Management: Learn to manage risks effectively to protect your capital.

With a strong foundation, you can confidently approach trading and make informed decisions in the stock market.

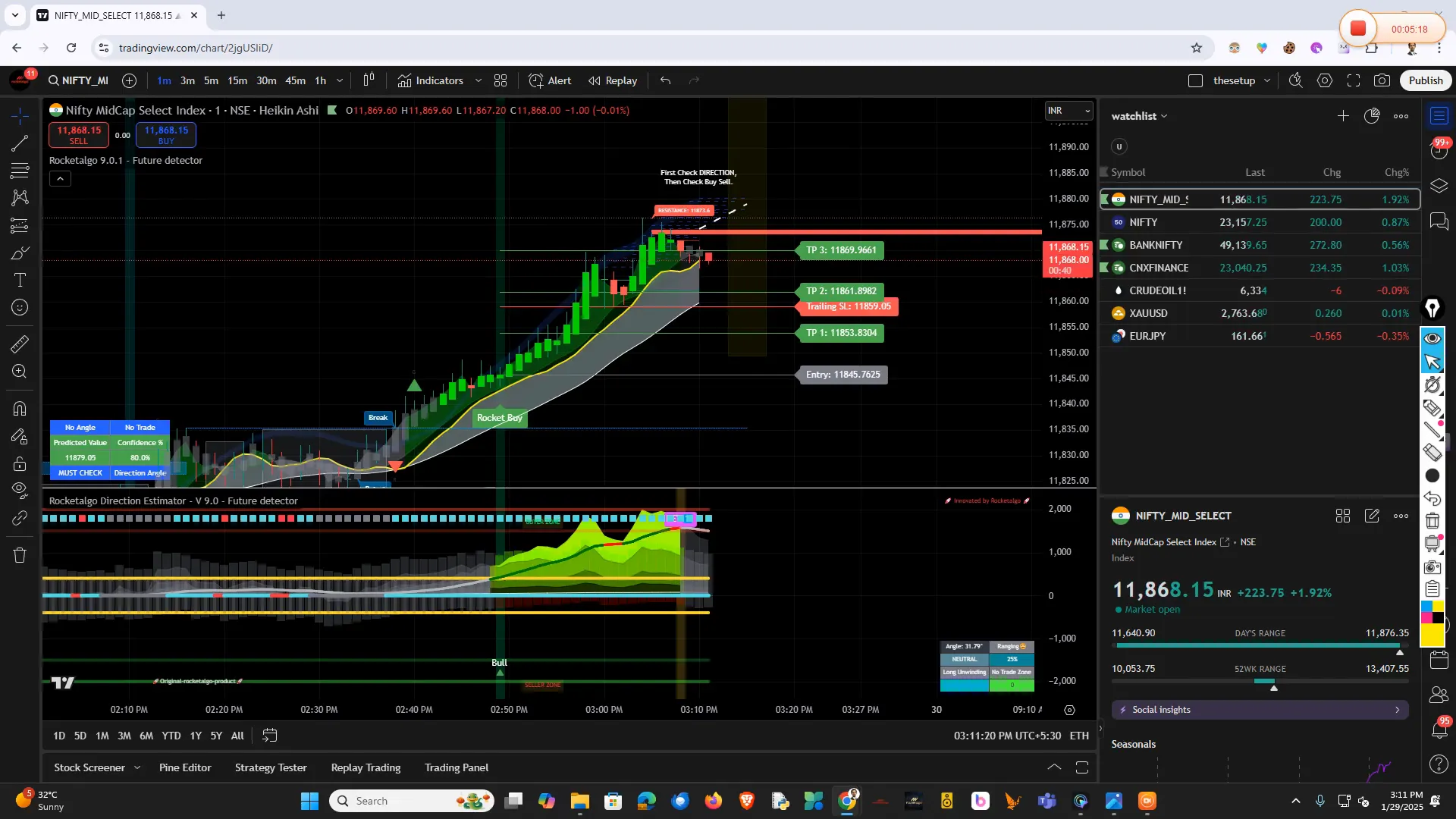

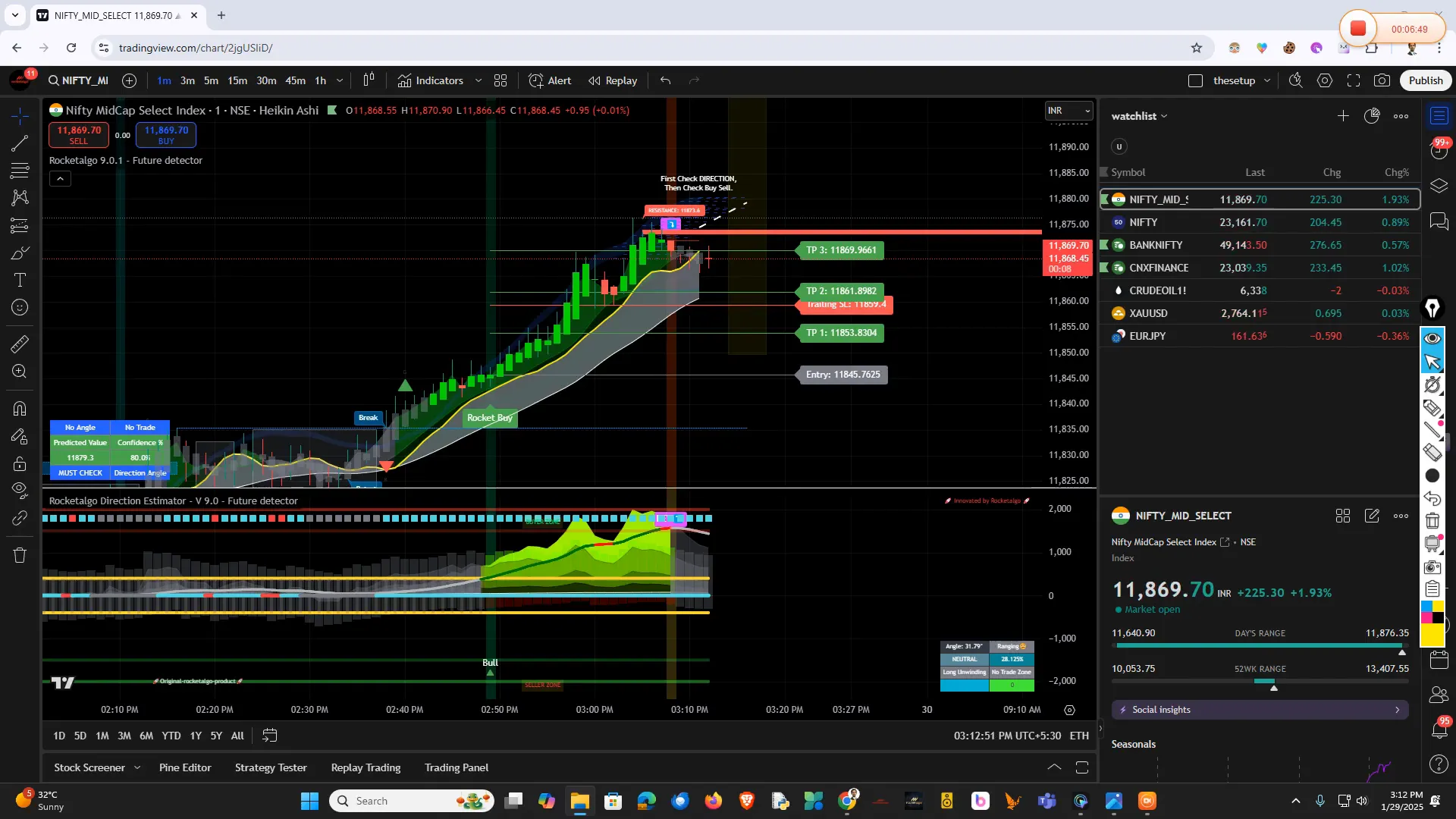

🎯 Setting Targets in Trading

Setting targets is a crucial aspect of trading strategy. It helps traders define their profit goals and establish a clear plan of action. Without targets, traders may find themselves making impulsive decisions that can lead to losses.

Targets should be realistic and based on market analysis. Consider factors such as historical price movements, volatility, and support and resistance levels when setting your targets.

Types of Targets

- Profit Targets: Specify the price at which you will exit a trade to secure profits.

- Stop-Loss Targets: Determine the price level at which you will exit to limit losses.

- Time-based Targets: Set a timeframe for your trades, whether it be short-term or long-term.

By clearly defining your targets, you can maintain discipline and avoid emotional trading decisions.

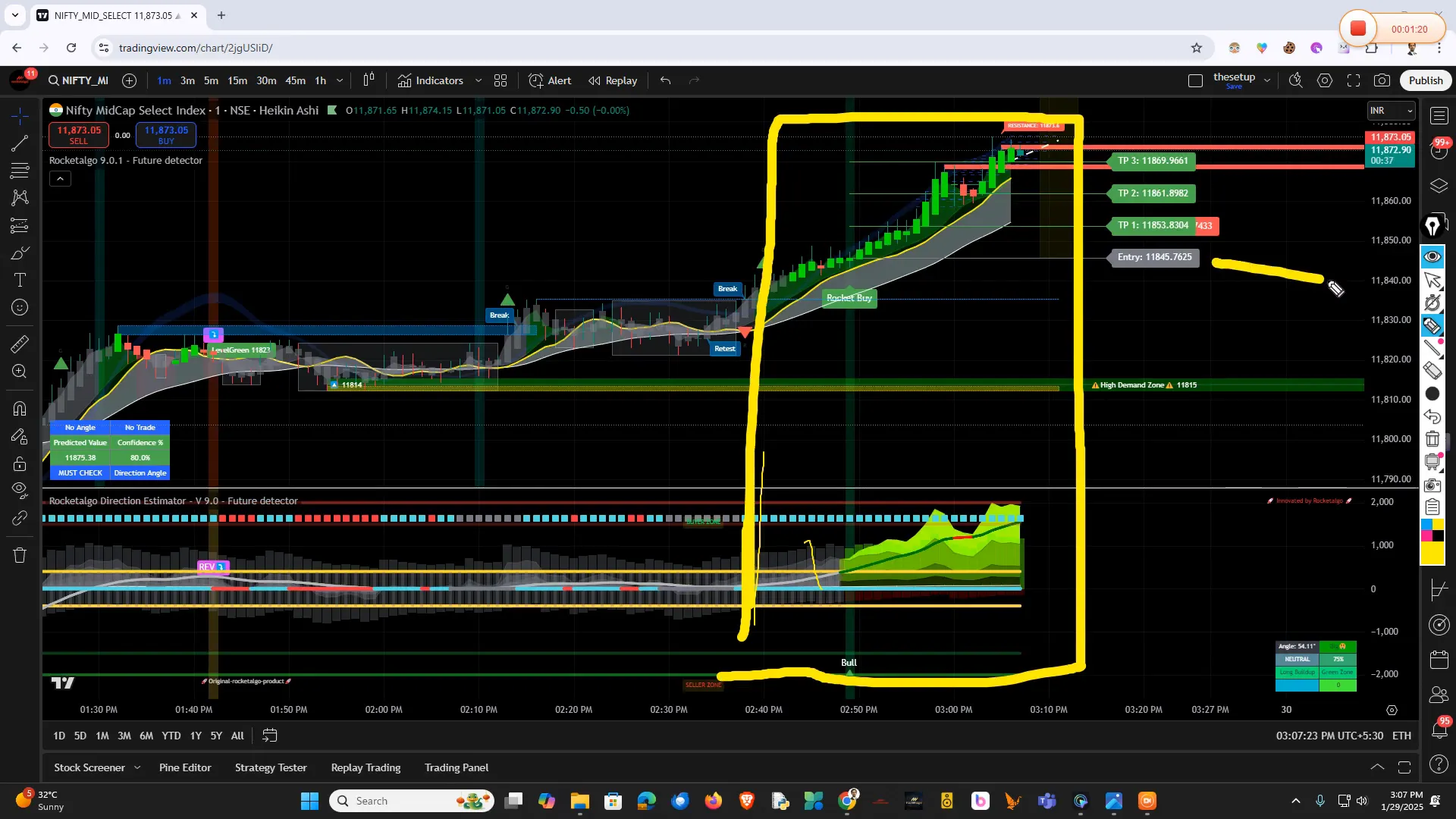

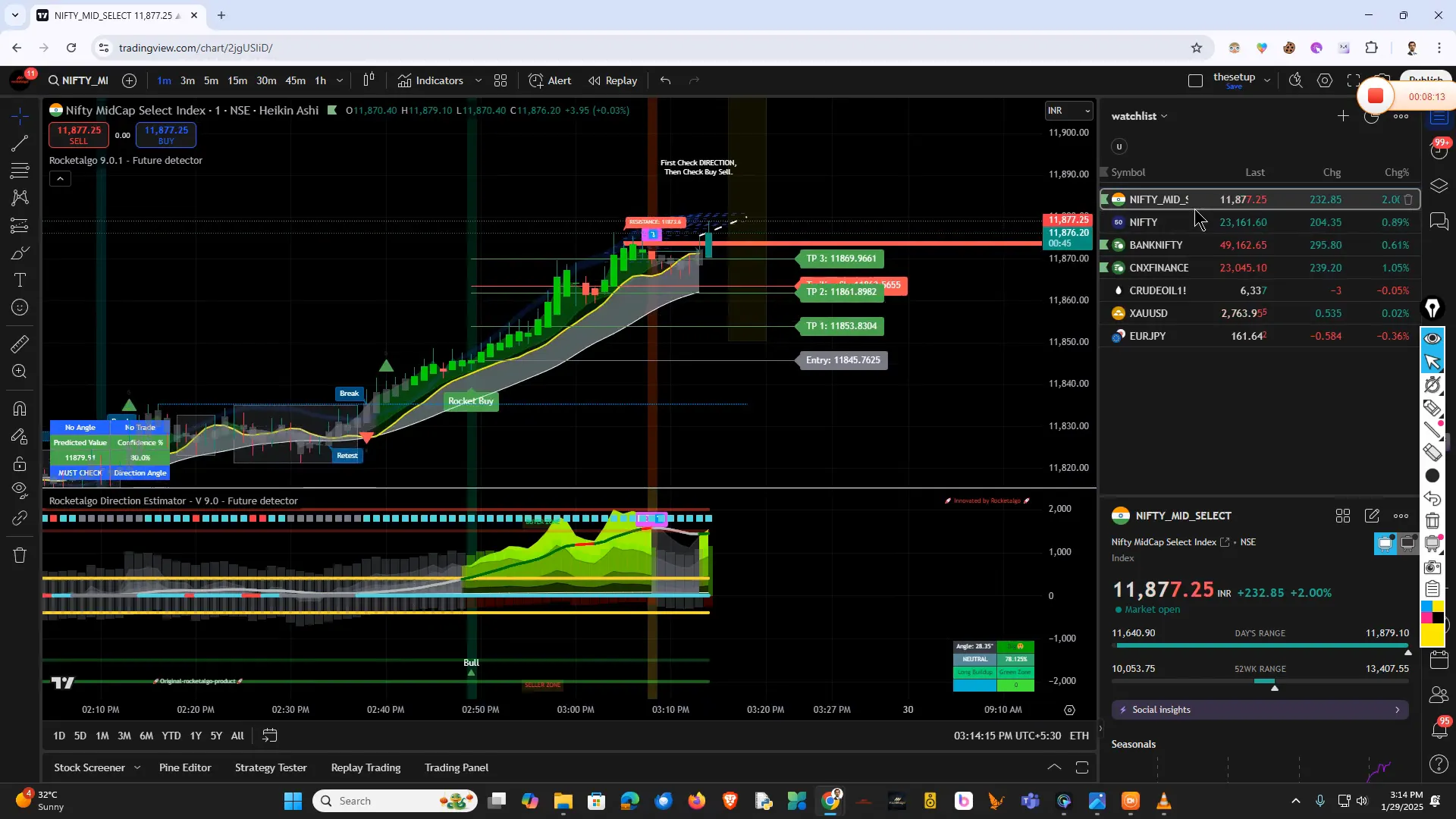

📊 Understanding Chart Trends

Charts are essential tools for traders, providing visual representations of price movements over time. Understanding chart trends can enhance your trading decisions significantly.

There are three primary types of trends: upward, downward, and sideways. Recognizing these trends helps traders determine the best times to enter or exit positions.

Identifying Trends

- Upward Trend: Characterized by higher highs and higher lows, indicating bullish market sentiment.

- Downward Trend: Defined by lower highs and lower lows, signaling bearish conditions.

- Sideways Trend: Occurs when prices move within a range, indicating indecision in the market.

Utilizing trend lines and indicators can help traders visualize these patterns and make informed trading choices.

💬 User Feedback and Confidence Building

Gathering user feedback is vital for improving trading strategies and tools. It can provide insights into what works and what needs adjustment. Positive feedback boosts confidence among traders, encouraging them to refine their strategies.

Traders should actively seek feedback from peers and mentors. Engaging in discussions can lead to new ideas and improved trading techniques.

Building Confidence through Feedback

- Constructive Criticism: Use feedback to identify areas for improvement.

- Success Stories: Share successful trades to motivate and inspire others.

- Continuous Learning: Stay open to learning and adapting based on user experiences.

Building confidence through feedback helps traders remain resilient in the face of market fluctuations.

📅 Market Updates and Predictions

Staying updated on market news and trends is essential for traders. Market updates provide valuable information that can influence trading decisions. Predictions based on market analysis can help traders anticipate price movements.

Traders should keep an eye on economic indicators, earnings reports, and geopolitical events that may impact the stock market.

Sources for Market Updates

- Financial News Websites: Stay informed through reputable financial news platforms.

- Social Media: Follow industry experts and analysts for real-time updates.

- Market Analysis Reports: Utilize reports from financial institutions for in-depth analysis.

By regularly checking for updates, traders can make timely decisions and capitalize on market opportunities.

🤖 Utilizing AI in Trading Strategies

Artificial Intelligence (AI) is revolutionizing the trading landscape. AI-driven tools can analyze vast amounts of data, identify patterns, and execute trades at lightning speed. Incorporating AI into trading strategies can enhance efficiency and accuracy.

Traders can leverage AI for market predictions, risk assessment, and even automated trading. These tools can simplify complex processes, allowing traders to focus on strategy development.

Benefits of AI in Trading

- Data Analysis: AI can process large datasets to find trends that may not be visible to the human eye.

- Speed: AI algorithms can execute trades faster than manual trading, capitalizing on fleeting opportunities.

- Emotion-free Trading: AI removes emotional biases, allowing for more objective decision-making.

As technology advances, traders who embrace AI will likely gain a competitive edge in the stock market.

📊 Key Indicators for Trading

Key indicators are essential tools that help traders analyze market conditions and make informed decisions. They provide insights into price movements, market trends, and overall sentiment, allowing traders to strategize effectively.

Common indicators include Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). Each of these indicators serves a unique purpose in a trader's toolkit.

Popular Trading Indicators

- Moving Averages: Help smooth out price data to identify trends over a specific period.

- RSI: Measures the speed and change of price movements, indicating overbought or oversold conditions.

- MACD: Shows the relationship between two moving averages of a security’s price, helping identify potential buy/sell signals.

By understanding and utilizing these indicators, traders can enhance their decision-making process and improve their overall trading performance in the stock market.

🗣 Language and Communication in Trading

Effective communication is vital in trading. It helps traders convey their strategies, share insights, and collaborate with others. The language used in trading can often be technical, requiring clarity to ensure all parties understand the concepts involved.

Using a mix of languages can be beneficial, especially in diverse trading communities. It allows traders to connect better and share ideas, but maintaining a level of professionalism and clarity is crucial.

Tips for Effective Communication in Trading

- Be Clear: Use simple language to explain complex concepts to avoid misunderstandings.

- Encourage Feedback: Foster an environment where traders can share their thoughts and improve collectively.

- Stay Professional: Maintain a professional tone, especially in formal communications.

By prioritizing effective communication, traders can build stronger networks and enhance their trading strategies in the stock market.

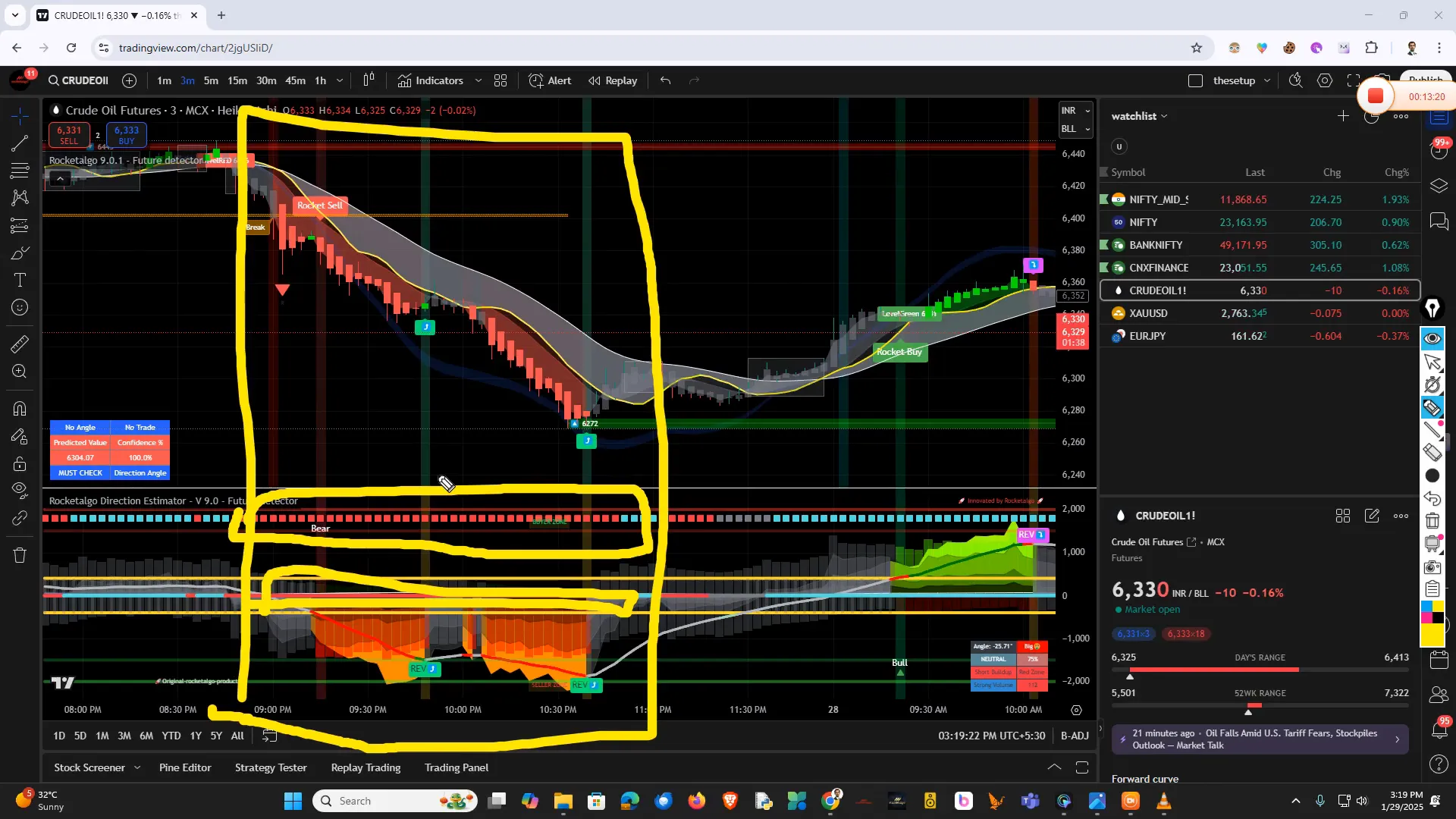

🛢️ Crude Oil Trading Insights

Crude oil trading presents unique opportunities and challenges. Understanding the factors that influence oil prices, such as geopolitical events, supply and demand dynamics, and market sentiment, is essential for successful trading.

Traders should monitor key reports, including inventory levels and production data, as these can heavily impact price movements. Additionally, technical analysis can help identify entry and exit points in crude oil trades.

Strategies for Crude Oil Trading

- Follow Market News: Stay updated on geopolitical developments and economic indicators that affect oil prices.

- Utilize Technical Analysis: Implement chart patterns and indicators to determine optimal trading points.

- Leverage Risk Management: Use stop-loss orders to protect your capital against unexpected market movements.

By focusing on these areas, traders can navigate the complexities of crude oil trading and capitalize on market opportunities.

📐 The Importance of Angles in Trading

Angles play a critical role in technical analysis. They help traders identify trends and potential reversal points in the market. By analyzing price action at different angles, traders can gain insights into market momentum and strength.

Utilizing angle-based techniques can enhance your trading strategy, allowing for more precise entries and exits in stock market trades.

Angle Analysis Techniques

- Trend Lines: Drawn at angles to identify support and resistance levels, helping traders anticipate price movements.

- Fibonacci Retracement: Utilizes angles to determine potential reversal levels based on historical price movements.

- Gann Angles: A technique that uses angles to forecast future price movements based on historical data.

Incorporating angle analysis into your trading strategy can provide valuable insights, improving your decision-making in the stock market.

🏦 Focus Areas in Trading: Mid Cap, Nifty, Bank Nifty

When trading, focusing on specific sectors or indices can lead to more effective strategies. Mid-cap stocks, Nifty, and Bank Nifty are crucial areas for traders to consider.

Each of these categories has distinct characteristics and can offer unique trading opportunities. Understanding their dynamics is vital for making informed decisions.

Overview of Focus Areas

- Mid Cap Stocks: Often provide higher growth potential compared to large caps, but come with increased volatility.

- Nifty Index: Represents the top 50 companies on the National Stock Exchange, serving as a barometer for the Indian stock market.

- Bank Nifty Index: Comprises the top banking stocks, reflecting the performance of the banking sector.

By concentrating on these focus areas, traders can develop specialized strategies that align with market trends and capitalize on potential growth.

❓ FAQ: Common Questions about Trading

As traders navigate the stock market, they often have questions about strategies, tools, and best practices. Addressing these common queries can provide valuable insights and foster a better understanding of trading.

Here are some frequently asked questions about trading:

Common Trading Questions

- What is the best trading strategy? There is no one-size-fits-all strategy. It depends on individual goals, risk tolerance, and market conditions.

- How do I manage risk in trading? Utilize stop-loss orders, diversify your portfolio, and only invest what you can afford to lose.

- What tools do I need for trading? Basic tools include charting software, trading platforms, and access to market news and analysis.

By addressing these questions, traders can feel more confident in their approaches and enhance their understanding of the stock market.

.jpg?alt=media&token=7e7f106e-ca8b-4cb2-9d13-2669607bd336/)