Feb 14, 2025

Trading Insights: Navigating the Stock Market with Confidence

Welcome to our daily market overview! In this session, we'll dive deep into the world of trading and the stock market, focusing on how to leverage the RocketAlgo setup for maximum results. Let's explore the current market trends and trading strategies that can help you excel.

Table of Contents

- 🚀 Introduction to RocketAlgo Setup

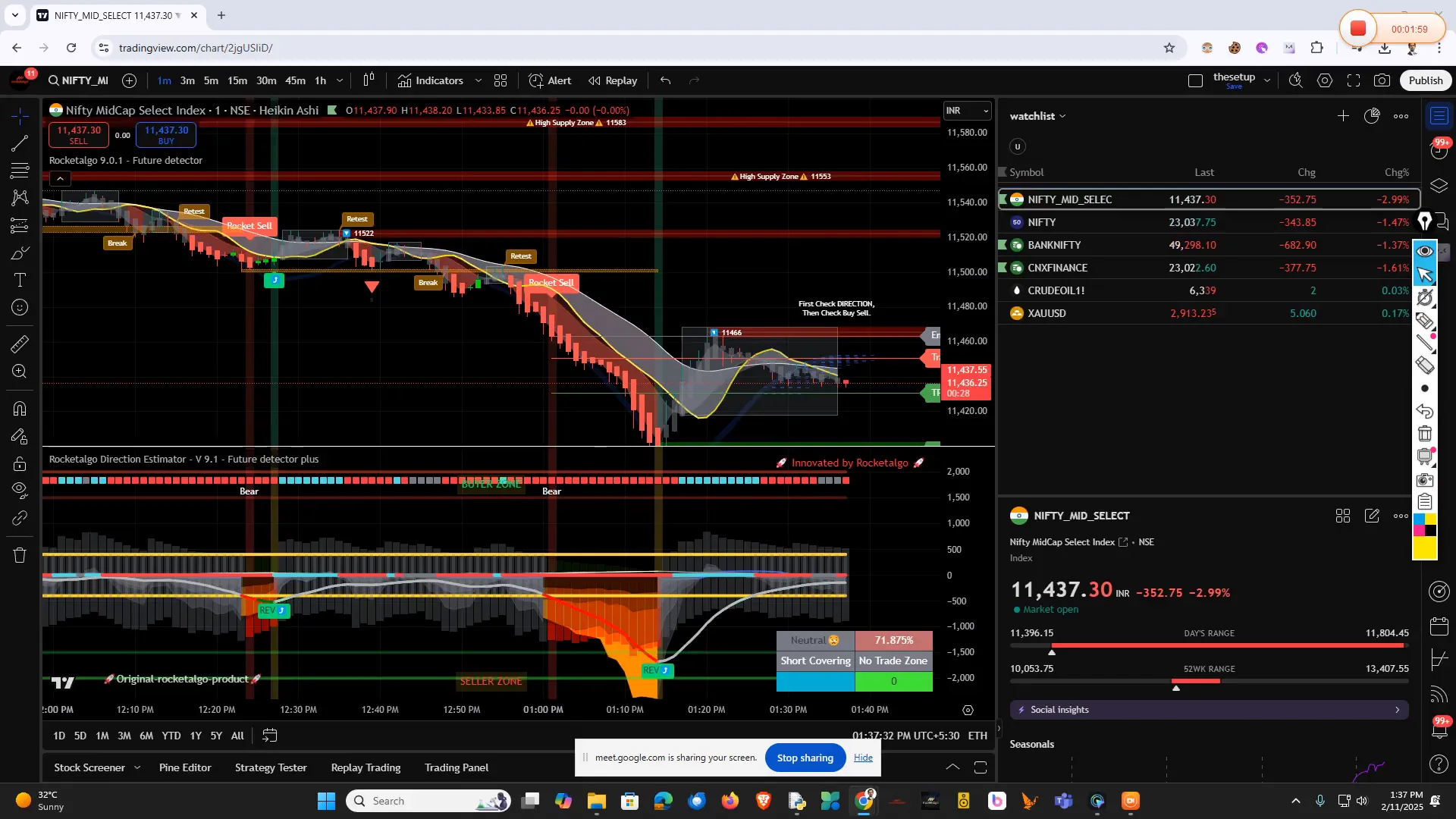

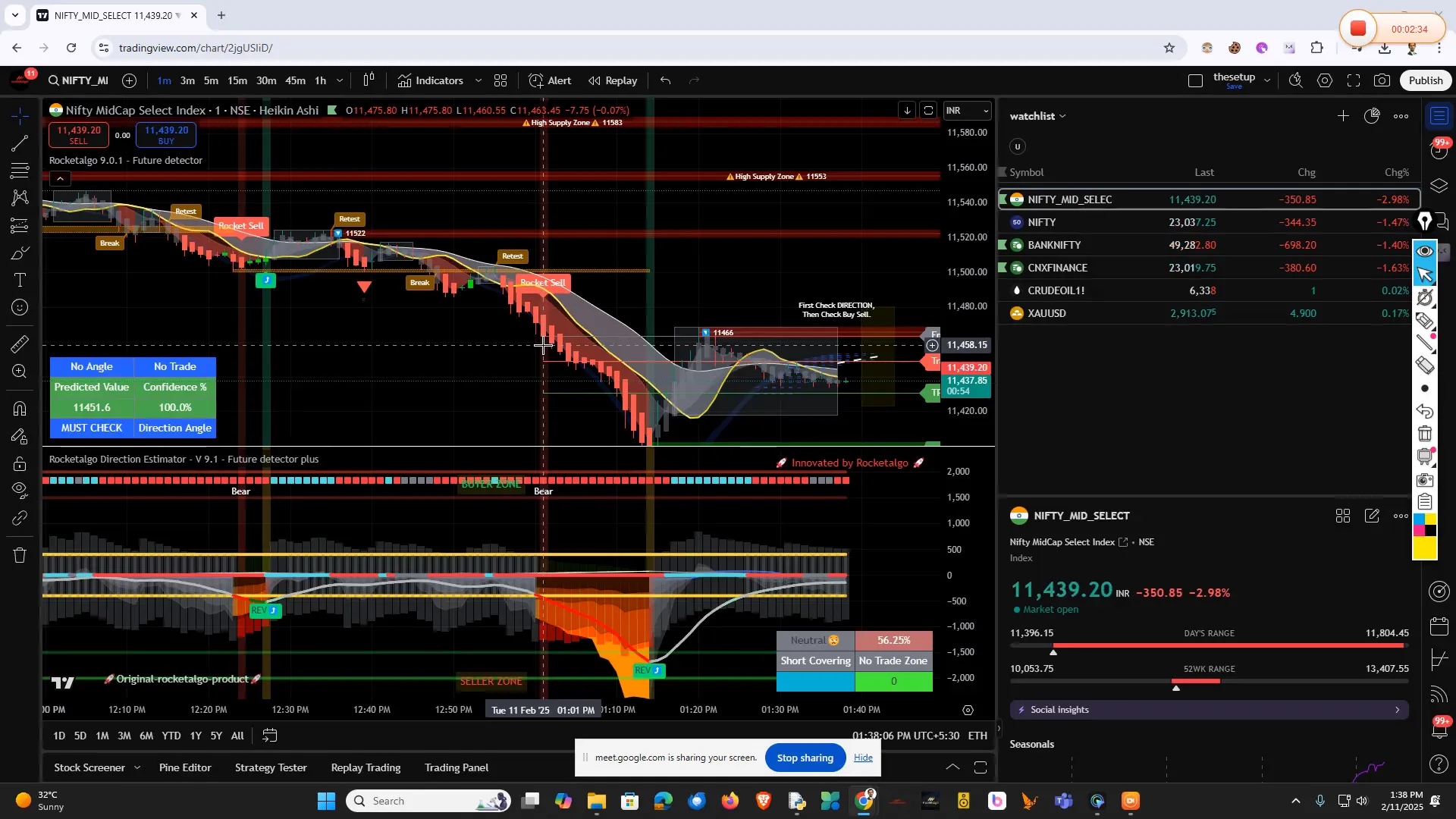

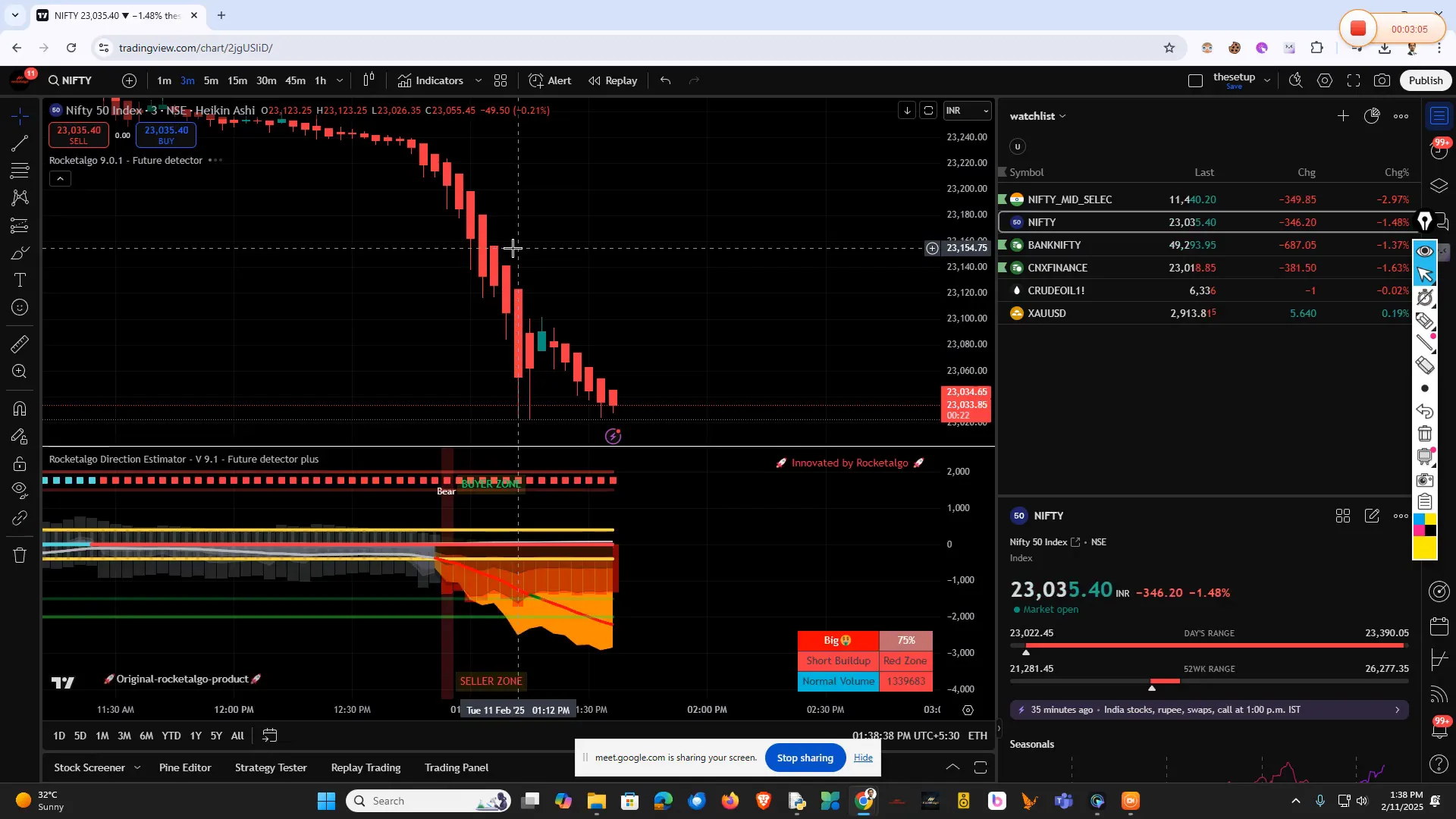

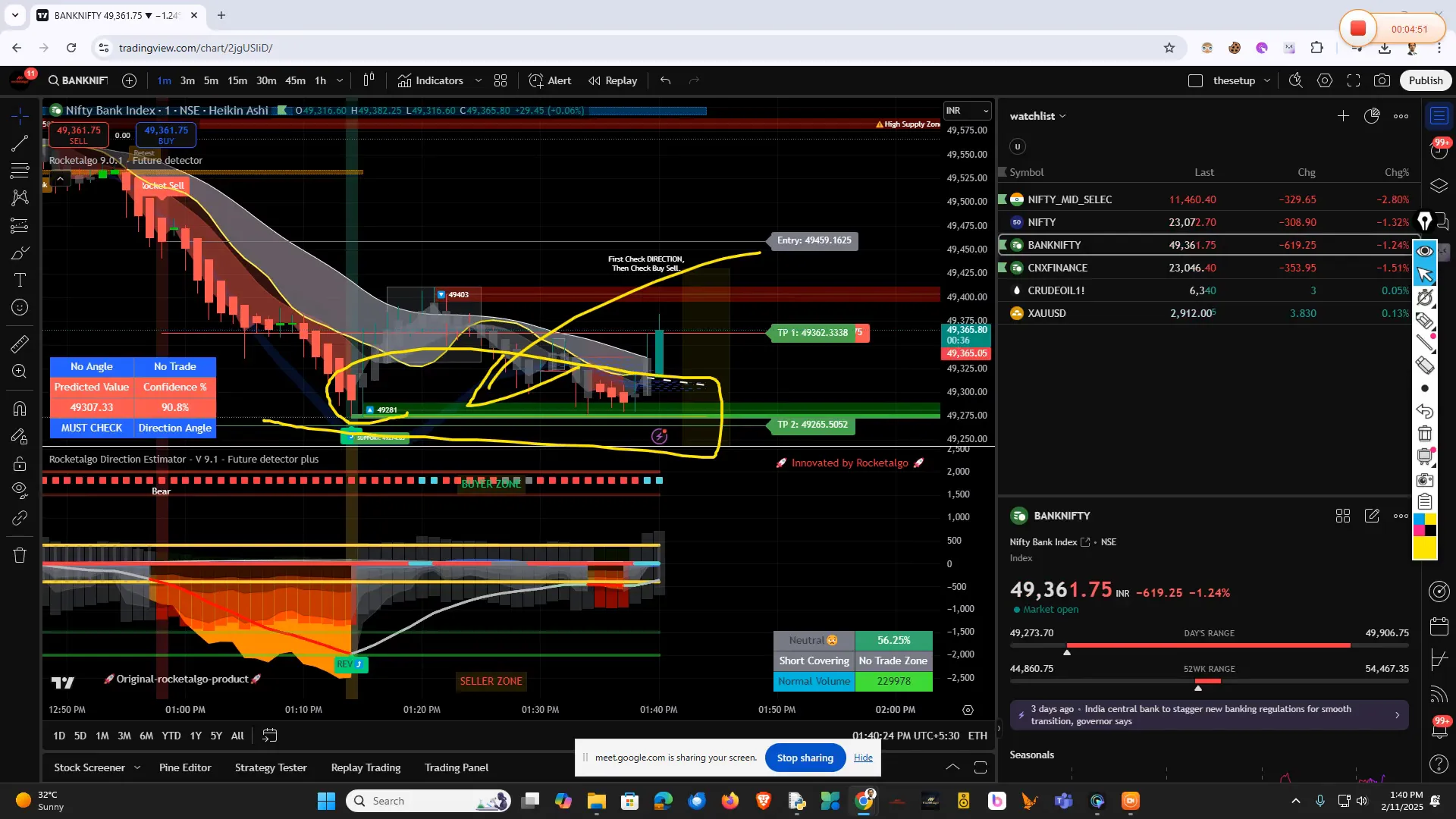

- 📈 Market Analysis and Current Trends

- 📊 Understanding Nifty Movement

- 📈 Mid Cap Performance

- 🤝 Building Trust in Trading Products

- 📈 Technical Analysis Techniques

- 💰 Profit Booking Strategies

- 🚫 Avoiding Common Trading Mistakes

- 📚 Understanding Forex Trading Basics

- 📉 Gold Market Insights

- 🌟 User Success Stories

- 🧠 Market Dynamics and Trading Psychology

- 📚 Training and Learning Resources

- 🔑 Key Takeaways for Traders

- 🤔 Final Thoughts and Q&A

- ❓ FAQ

🚀 Introduction to RocketAlgo Setup

The RocketAlgo setup is designed to empower traders in the stock market. It provides a robust framework for technical analysis and market visualization. The focus is on actionable insights rather than mere tips. The goal is to help you understand how to navigate the market with confidence.

Using RocketAlgo, traders can identify potential entry points and track trade movements effectively. This setup is not just about spotting trends; it's about harnessing data to make informed decisions. With this tool, you can maximize your trading results and minimize risks.

Key Features of RocketAlgo

- Data Visualization: Clear graphical representation of market data.

- Real-Time Alerts: Instant notifications for critical market movements.

- Customizable Dashboard: Tailor the interface to suit your trading style.

- Backtesting Capabilities: Evaluate strategies using historical data.

📈 Market Analysis and Current Trends

Understanding market trends is crucial for successful trading. Currently, the stock market is experiencing significant fluctuations, creating both challenges and opportunities for traders. By analyzing market data, we can gain insights into potential movements and adjust our strategies accordingly.

Current Market Sentiment

The sentiment among investors is mixed, with many feeling uncertain due to recent declines. However, for traders, this volatility can be an opportunity to capitalize on rapid price changes. It's essential to stay informed about market conditions and adjust your trading plans.

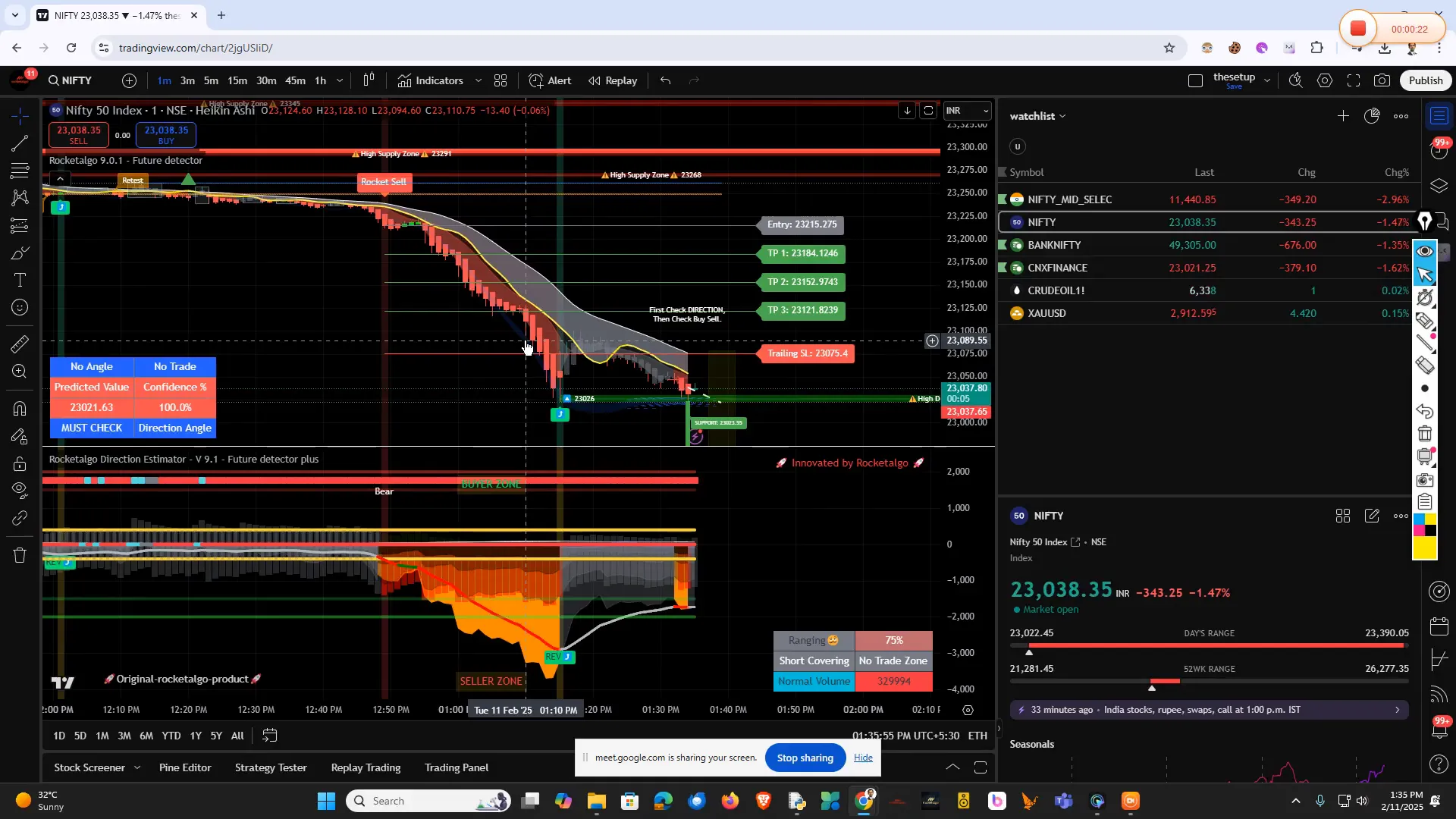

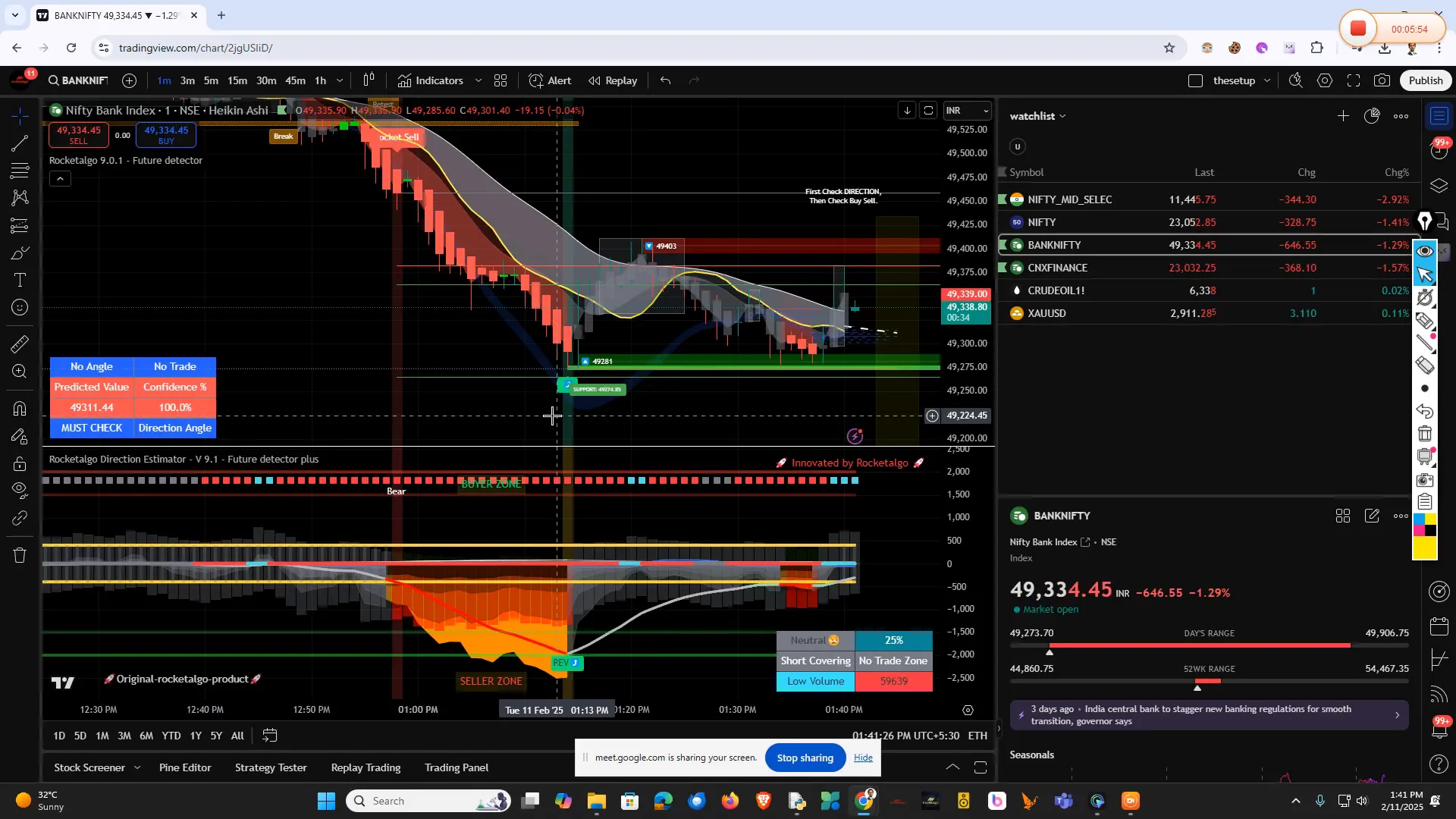

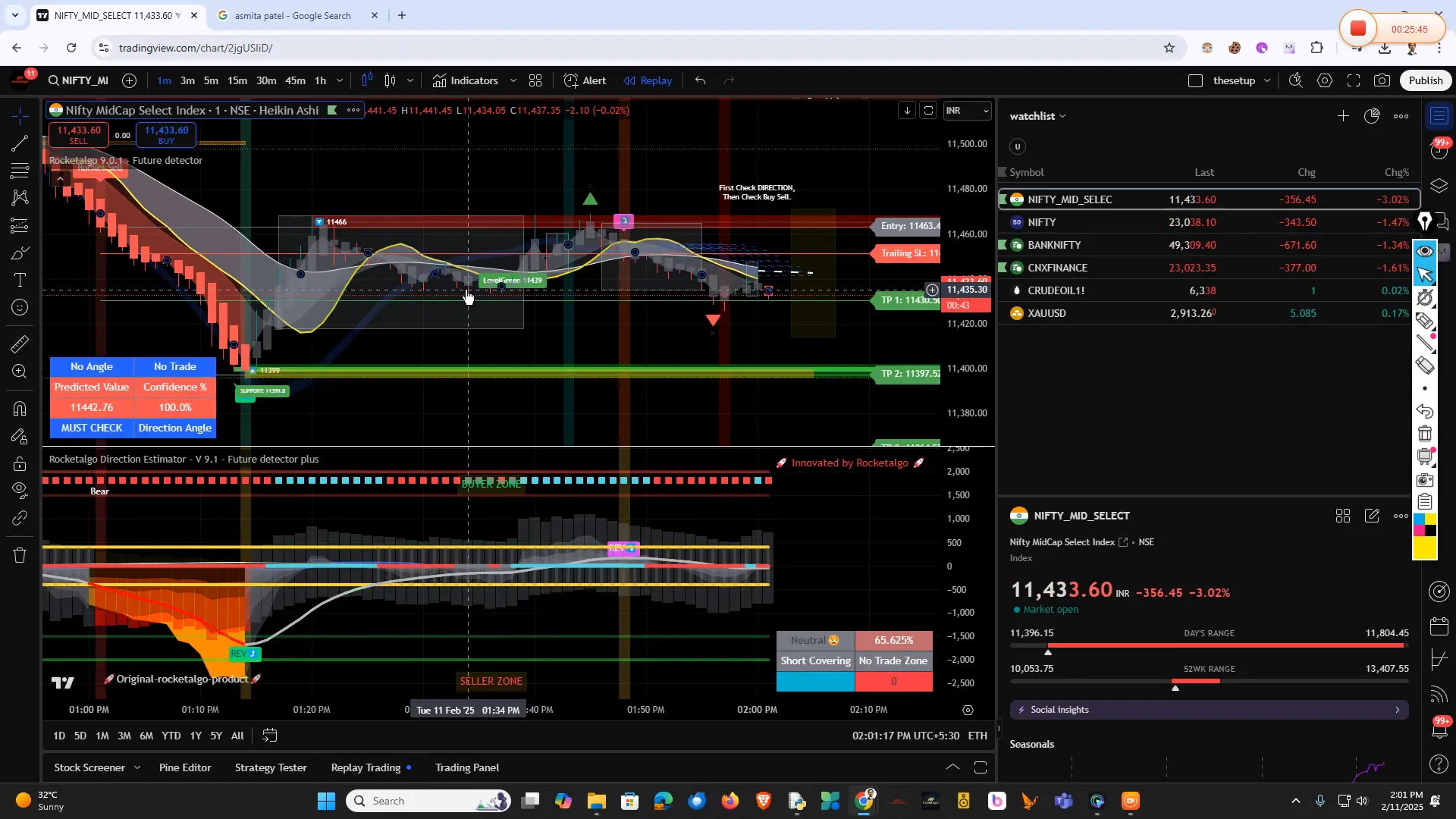

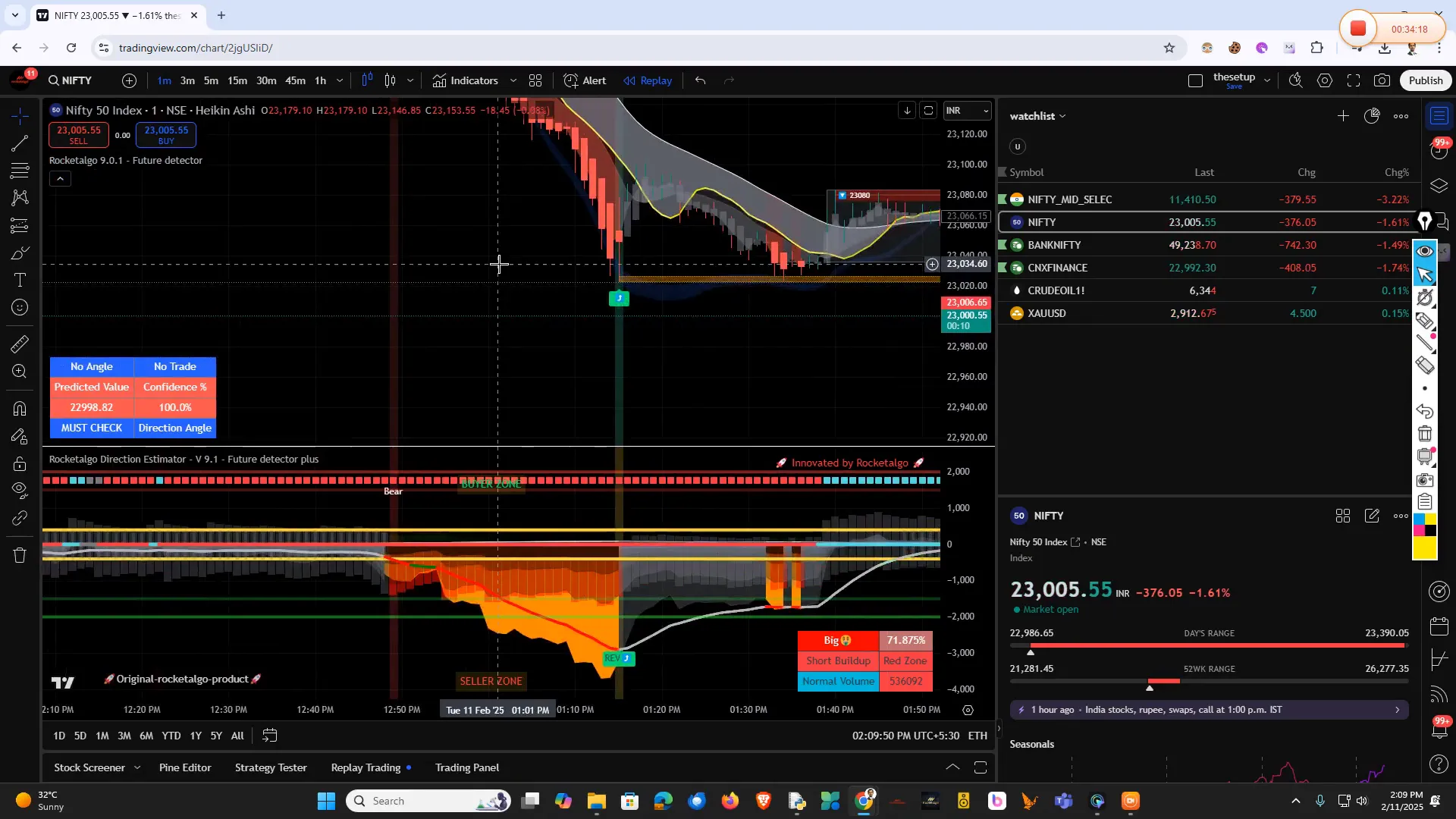

📊 Understanding Nifty Movement

Nifty, as a benchmark index, plays a vital role in understanding broader market movements. Recent trends indicate significant ups and downs, with traders needing to remain vigilant. By observing Nifty's behavior, traders can identify potential entry and exit points.

Key Observations on Nifty

- Short-Term Trends: Recent data shows small trades that have yielded positive results.

- Momentum Shifts: A sudden shift in momentum can lead to substantial gains.

- Patience is Key: Waiting for the right moment can lead to better trading outcomes.

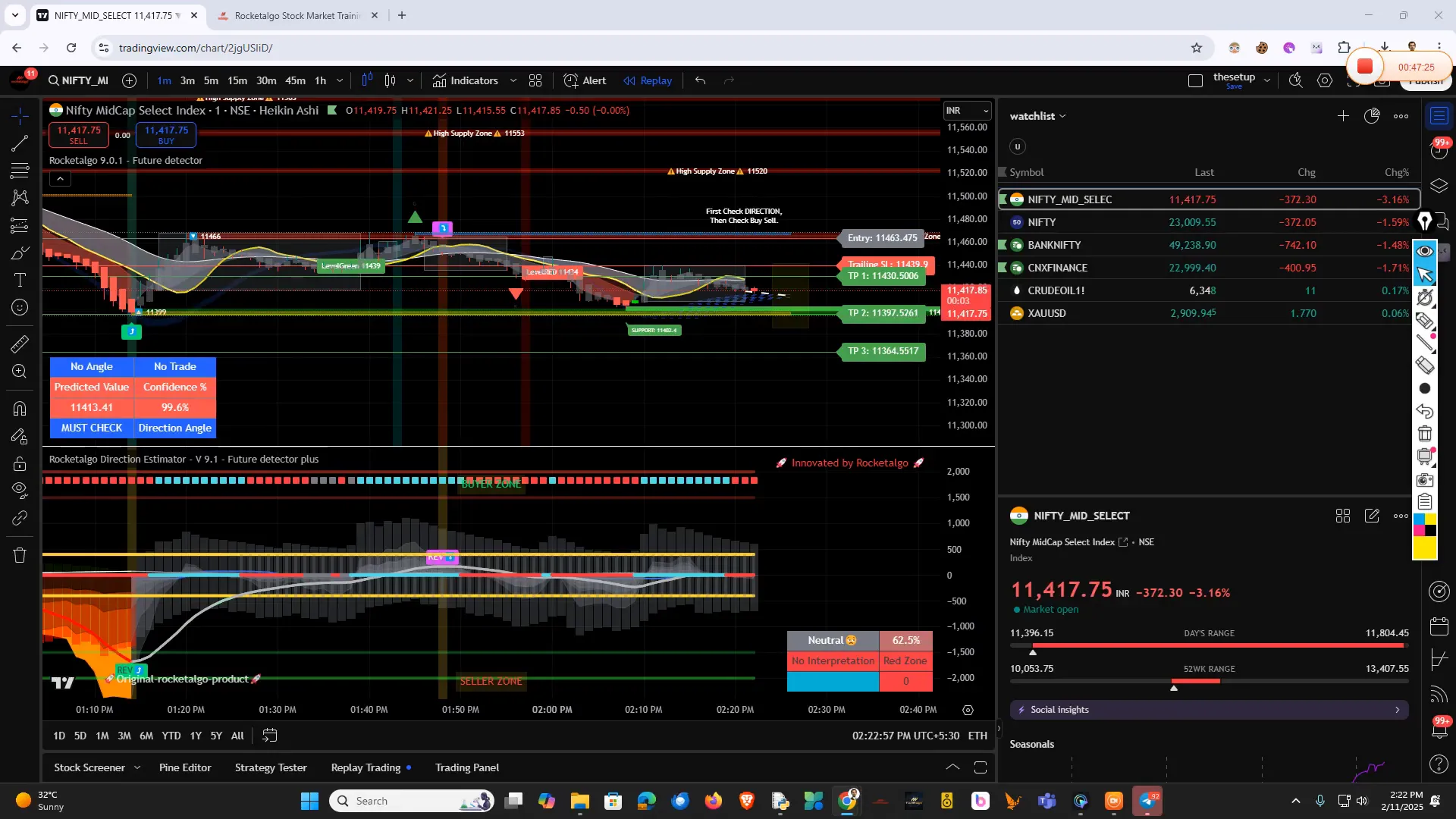

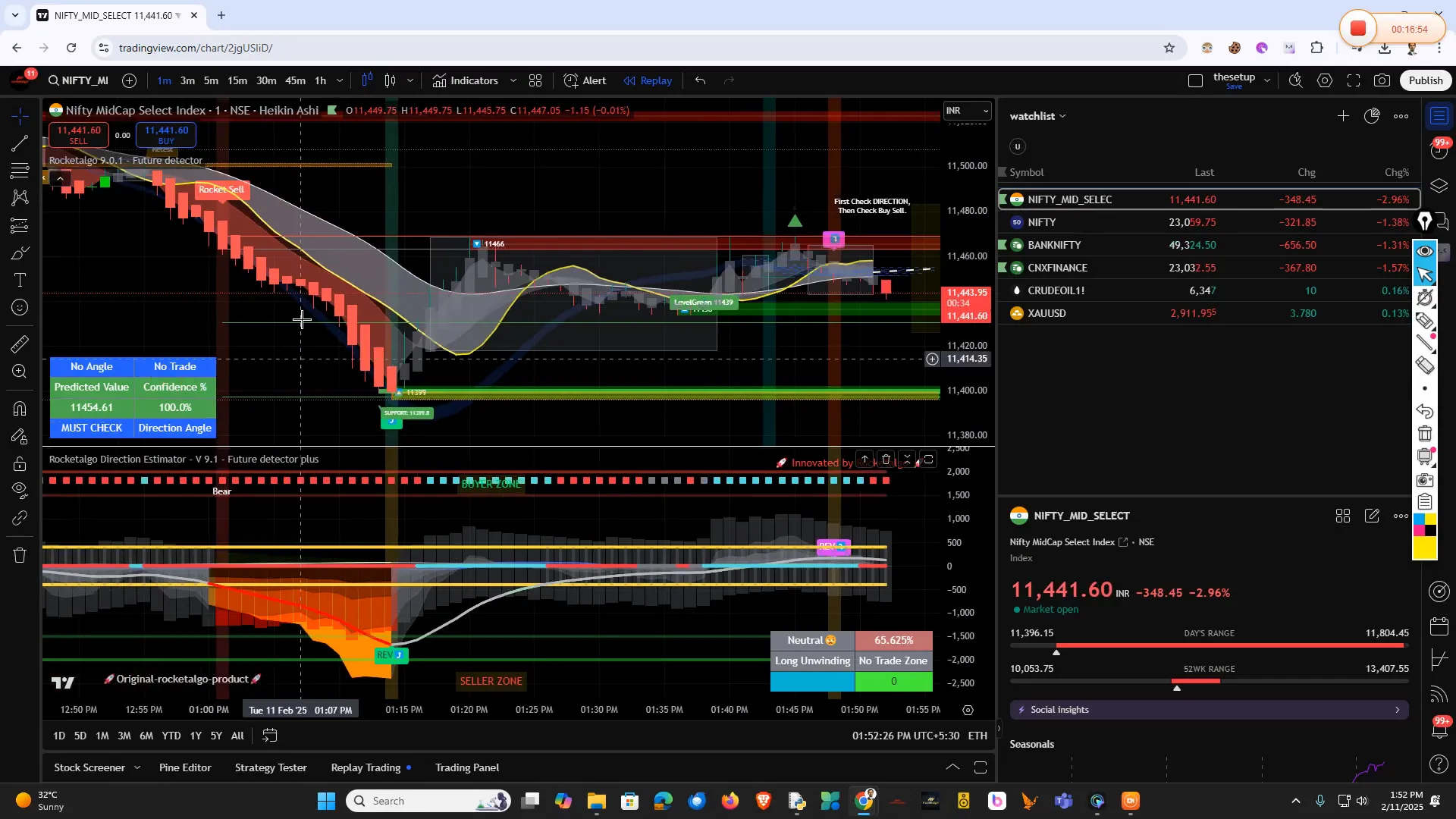

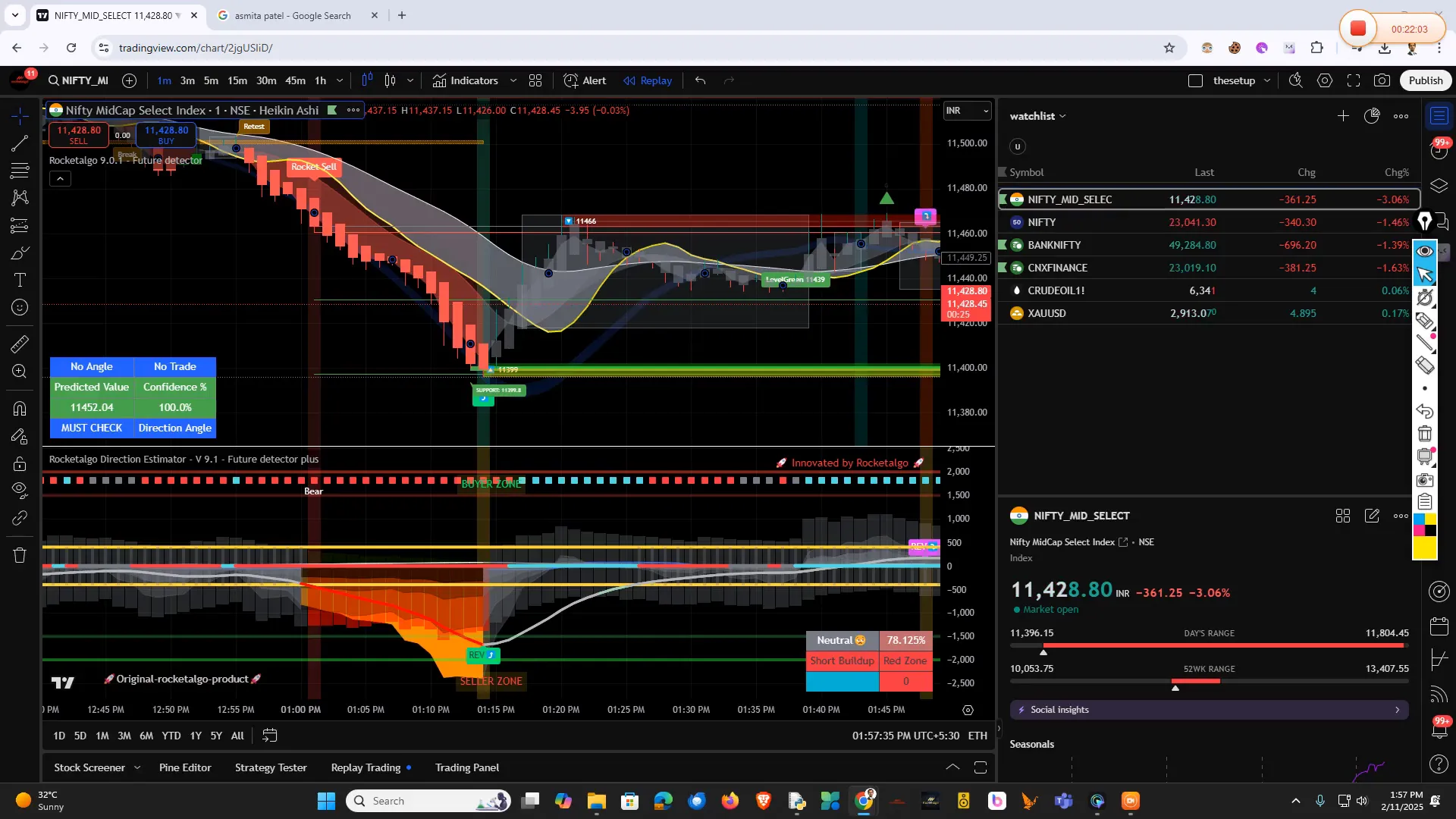

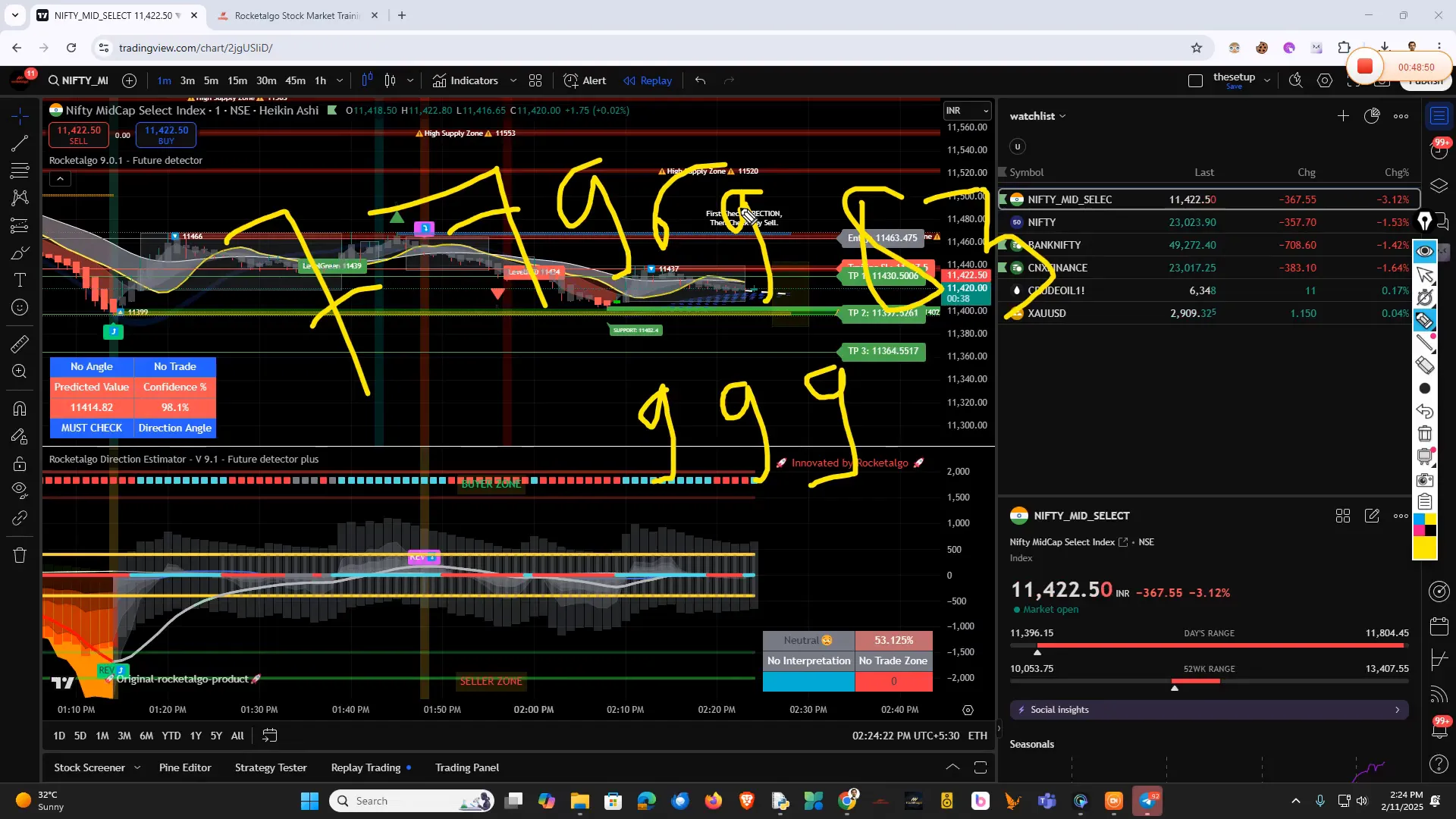

📈 Mid Cap Performance

The mid-cap segment has shown resilience despite broader market fluctuations. Traders should pay close attention to this sector as it often presents unique opportunities. Monitoring mid-cap stocks can reveal patterns not always visible in large-cap stocks.

Strategies for Trading Mid Caps

- Focus on Momentum: Identify stocks with strong upward trends.

- Risk Management: Use stop-loss orders to protect your capital.

- Diversify Your Portfolio: Spread investments across different mid-cap stocks to mitigate risks.

🤝 Building Trust in Trading Products

Trust is paramount when it comes to trading products. Many traders hesitate due to past experiences or skepticism about new tools. It's essential to understand the capabilities of any trading product before committing.

Why Trust RocketAlgo?

- Proven Track Record: RocketAlgo has been operational for several years, demonstrating consistent results.

- Transparent Operations: Clear communication and support for users enhance credibility.

- User Testimonials: Positive feedback from users showcases the effectiveness of the product.

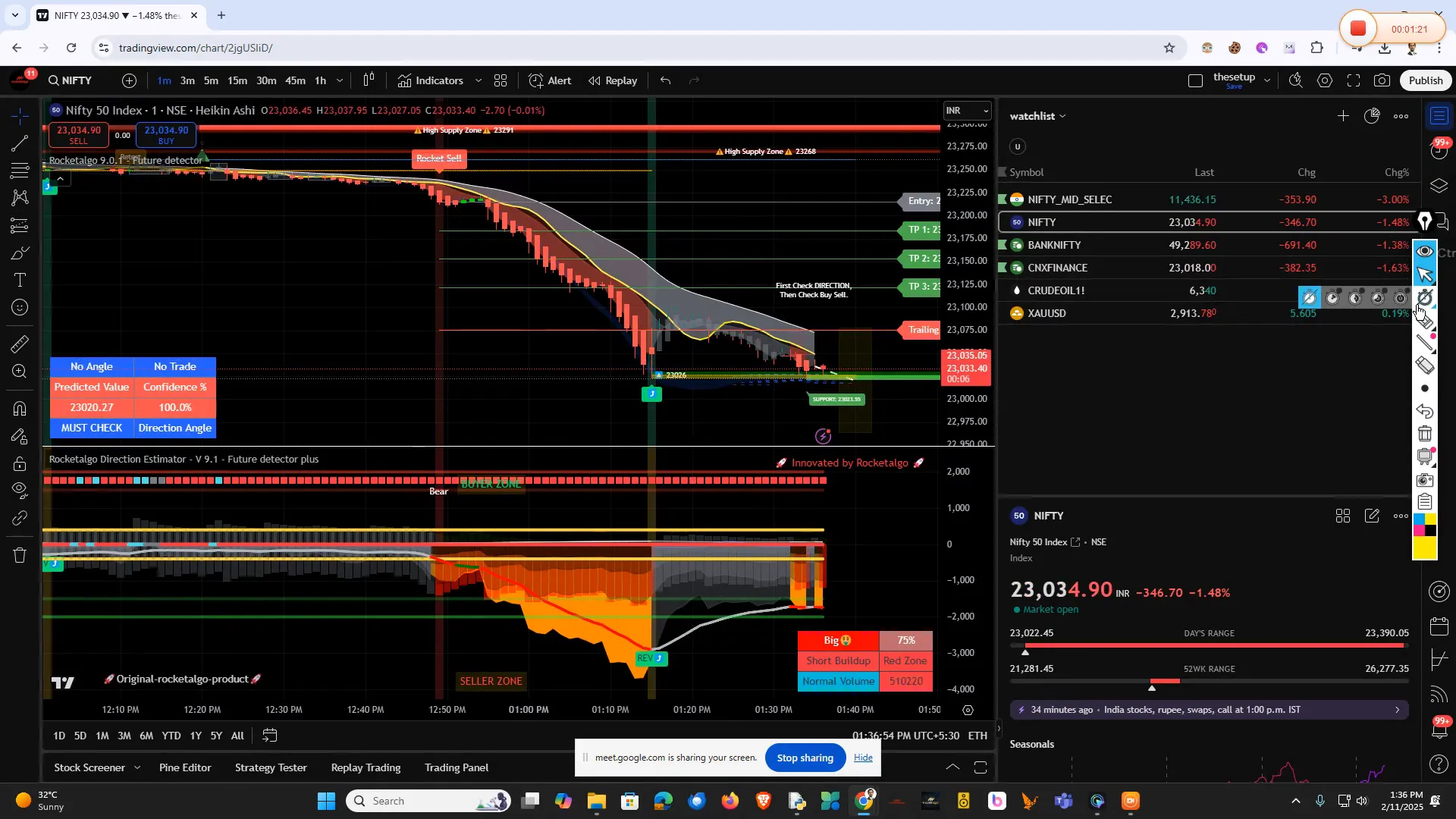

📈 Technical Analysis Techniques

Technical analysis is a cornerstone of successful trading. Understanding various techniques can significantly enhance your trading strategy. RocketAlgo provides tools to facilitate this analysis, making it easier for traders to spot trends and reversals.

Essential Technical Analysis Tools

- Moving Averages: Helps smooth out price data to identify trends.

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- Support and Resistance Levels: Key price levels where the market tends to reverse.

💰 Profit Booking Strategies

Knowing when to book profits is critical in trading. Many traders struggle with this aspect, often leading to missed opportunities or losses. Implementing a clear profit booking strategy can help you secure gains and manage risks effectively.

Effective Profit Booking Techniques

- Set Target Prices: Determine exit points before entering a trade.

- Trailing Stops: Adjust stop-loss orders as the price increases to lock in profits.

- Partial Profit Booking: Take profits on a portion of your position while letting the rest ride.

🚫 Avoiding Common Trading Mistakes

Avoiding common pitfalls is essential for any trader. Many new and even experienced traders fall into these traps, which can significantly impact their trading success. Awareness and education are key to overcoming these challenges.

Common Mistakes to Avoid

- Emotional Trading: Making decisions based on emotions rather than data.

- Overtrading: Taking too many trades without proper analysis.

- Ignoring Risk Management: Failing to set stop-loss orders can lead to significant losses.

📚 Understanding Forex Trading Basics

Forex trading, or foreign exchange trading, is the process of exchanging one currency for another in the global market. It operates 24 hours a day, five days a week, and is known for its high liquidity and volatility. Traders engage in Forex to profit from fluctuations in currency values.

Understanding the basics of Forex trading is crucial for anyone looking to enter this market. Here are a few fundamental concepts:

- Currency Pairs: Currencies are traded in pairs, such as EUR/USD, where the first currency is the base currency and the second is the quote currency.

- Leverage: Forex trading often involves using leverage, which allows traders to control larger positions with a smaller amount of capital.

- Pips: A pip is the smallest price move in a currency pair and is a standard unit of measurement for price movements.

Key Strategies for Forex Trading

To succeed in Forex trading, traders should adopt specific strategies that align with their risk tolerance and trading goals. Here are some effective strategies:

- Technical Analysis: Use charts and indicators to identify trends and price patterns.

- Fundamental Analysis: Analyze economic indicators and news events that can affect currency values.

- Risk Management: Implement stop-loss orders to protect against significant losses.

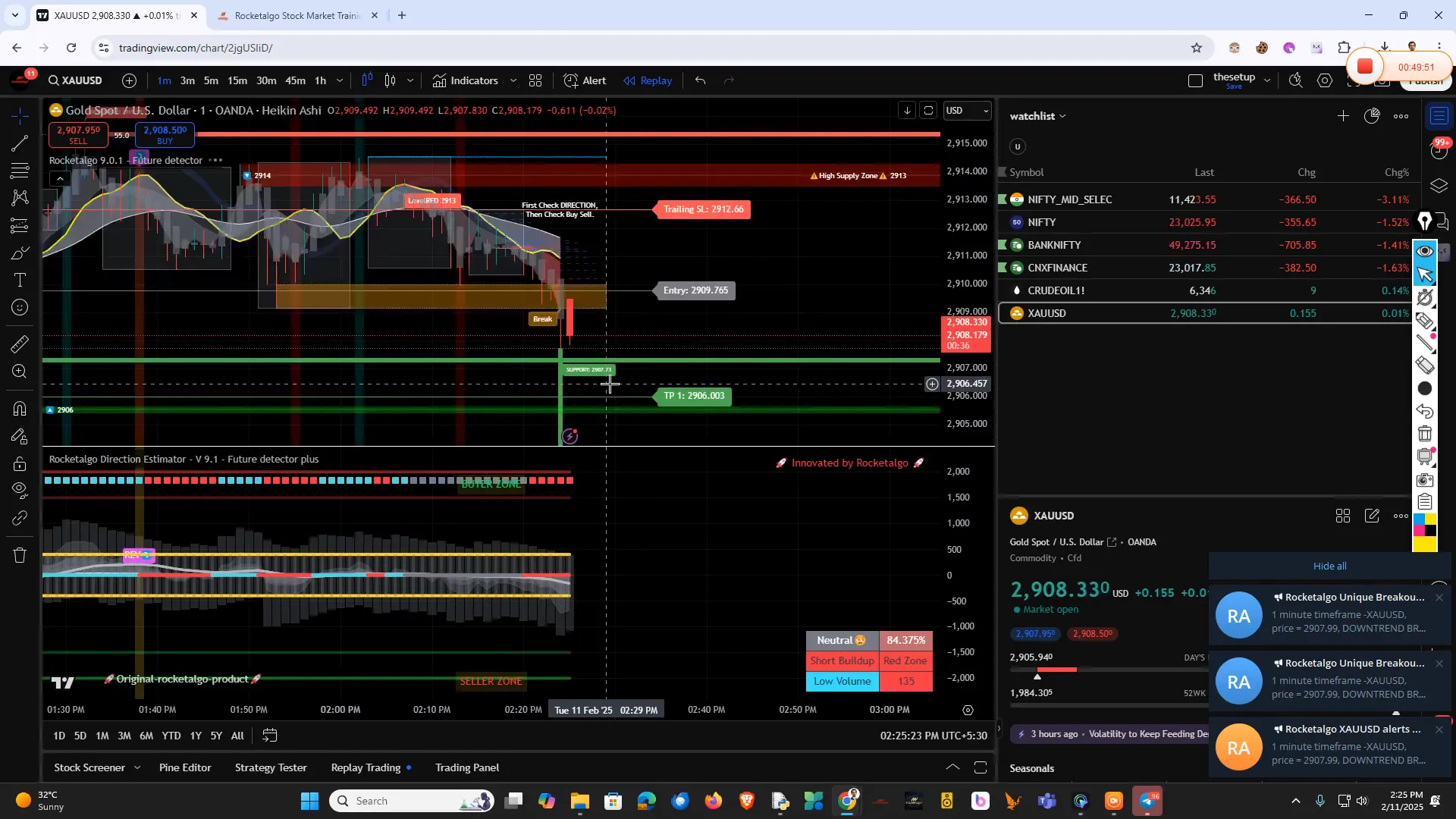

📉 Gold Market Insights

The gold market remains a popular choice for investors seeking safety during uncertain times. Understanding gold's role in the trading landscape can provide valuable insights.

Gold often behaves differently than stocks and currencies. It can serve as a hedge against inflation and currency devaluation. Here are some key factors influencing the gold market:

- Economic Data: Reports on inflation, interest rates, and employment can affect gold prices.

- Geopolitical Events: Political instability often drives investors to gold as a safe haven.

- Market Sentiment: The sentiment of traders can influence demand and prices significantly.

Current Trends in Gold Trading

Recent trends indicate that gold prices are experiencing fluctuations based on global economic conditions. Keeping an eye on these trends can help traders make informed decisions.

- Price Resistance Levels: Identifying key resistance levels can help traders determine potential entry points.

- Technical Indicators: Using tools like moving averages can provide clarity on market trends.

- Long-term vs. Short-term Trading: Decide whether to hold gold for long-term gains or trade it for short-term profits.

🌟 User Success Stories

Real success stories from users can inspire and motivate new traders. Here are a few testimonials from traders who have benefited from using the RocketAlgo setup:

- Vijay P.: "I've been using RocketAlgo for over a year. My trading consistency has improved dramatically, and I've seen significant profit growth."

- Shalini R.: "The insights I gain from RocketAlgo help me make informed decisions. I'm no longer trading based on emotions."

- Ravi K.: "I started with a small capital, and thanks to the strategies I've learned, I now trade confidently and profitably."

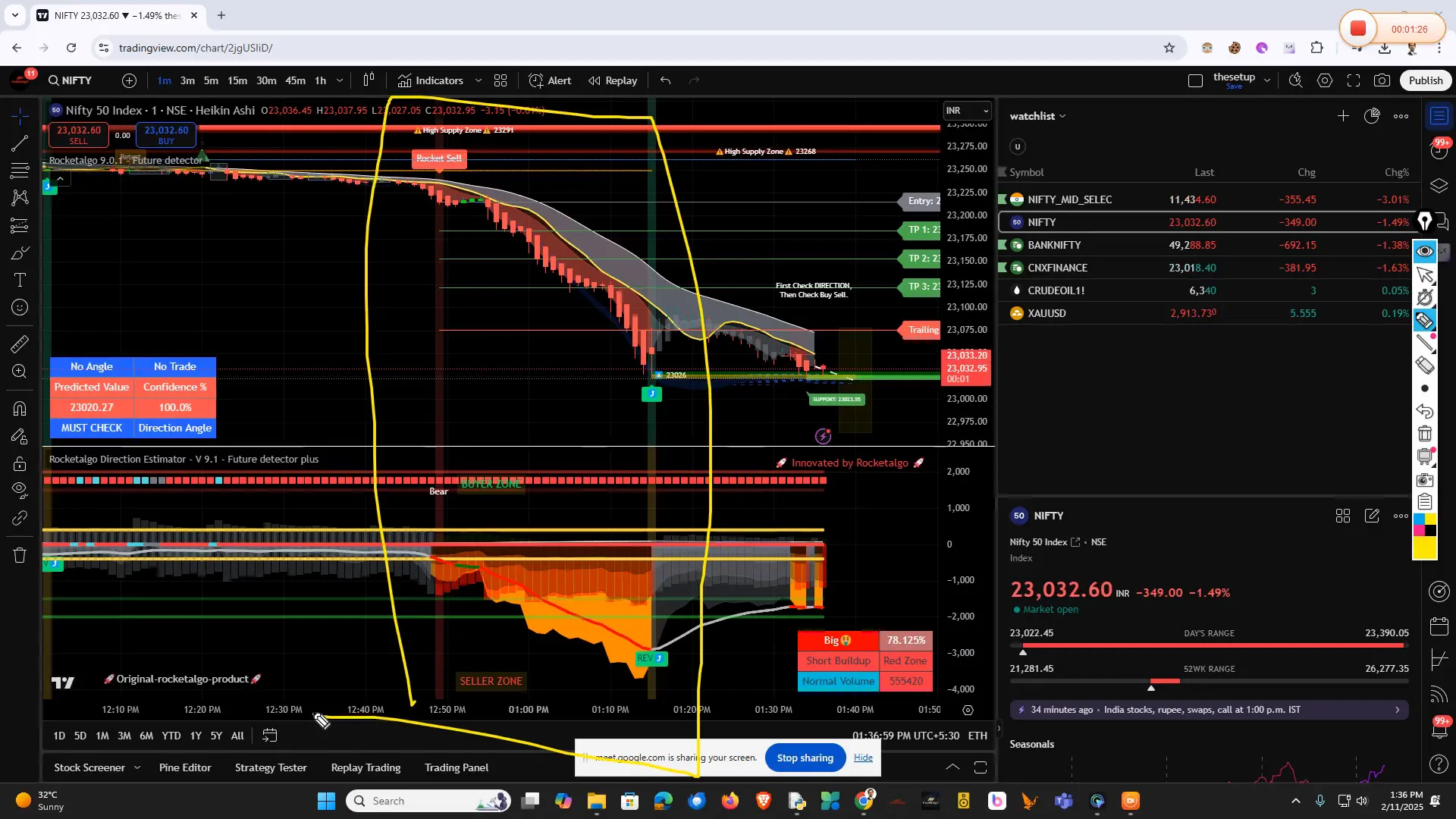

🧠 Market Dynamics and Trading Psychology

Understanding market dynamics and trading psychology is essential for any trader. The market is influenced by various factors, including economic indicators, trader sentiment, and global events. Here are some psychological aspects to consider:

- Fear and Greed: These emotions can significantly impact trading decisions. Fear can lead to missed opportunities, while greed can result in overtrading.

- Discipline: Sticking to a trading plan is crucial. Successful traders maintain discipline even during volatile market conditions.

- Continuous Learning: The market evolves, and so should your knowledge. Stay updated with market trends and trading strategies.

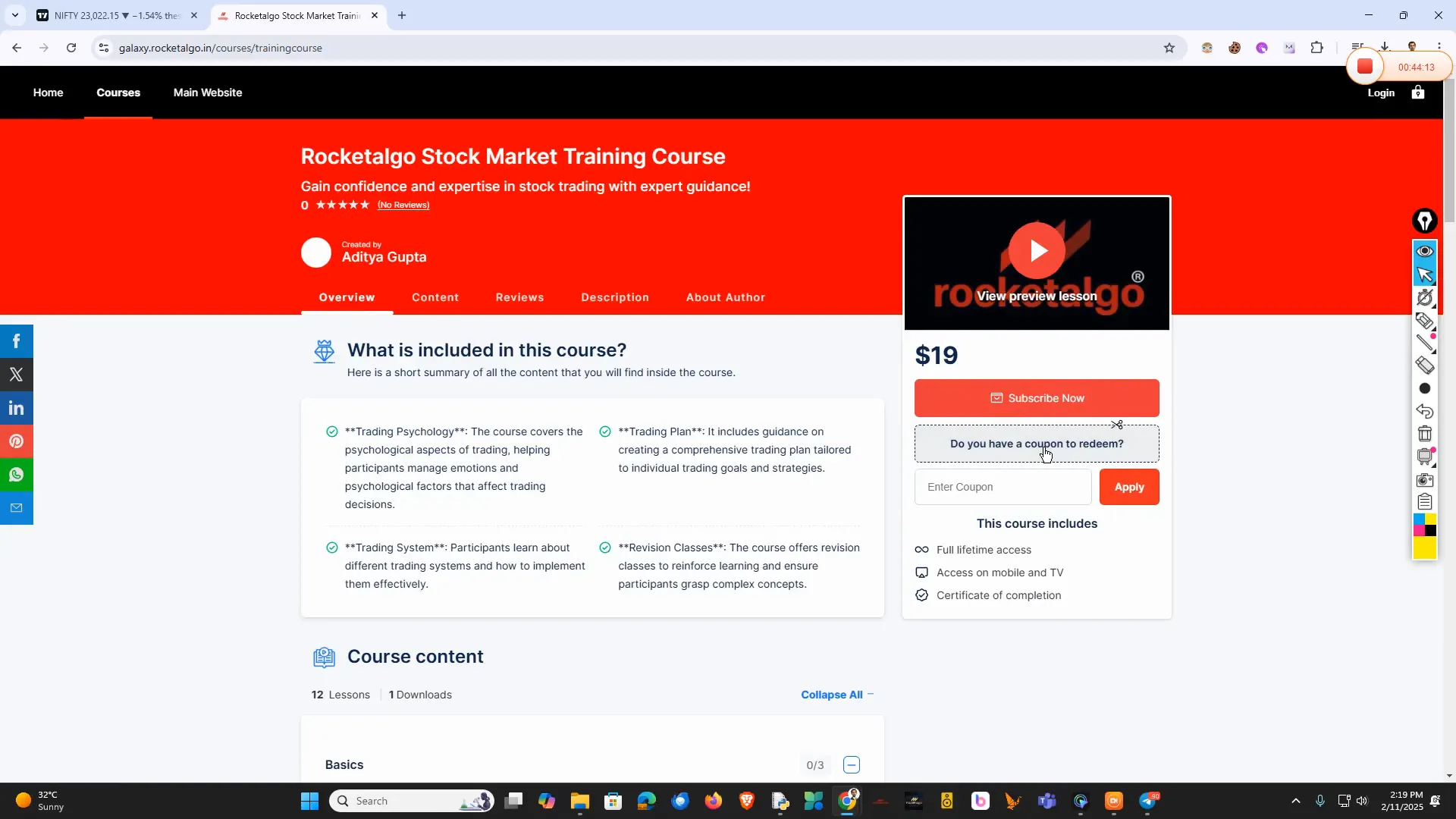

📚 Training and Learning Resources

Continuous education is vital for success in trading. Here are some valuable resources to enhance your trading skills:

- Webinars and Workshops: Participate in live trading sessions to learn from experienced traders.

- Online Courses: Enroll in comprehensive courses that cover various aspects of trading, including Forex and stock market strategies.

- Trading Communities: Join forums and groups where traders share insights, tips, and experiences.

🔑 Key Takeaways for Traders

As we wrap up, here are the essential takeaways for traders:

- Stay Informed: Keep track of market trends and economic indicators.

- Practice Risk Management: Protect your capital with effective risk management strategies.

- Embrace Continuous Learning: The market is always changing; adapt and learn.

🤔 Final Thoughts and Q&A

Trading in the stock market and Forex requires a blend of knowledge, strategy, and discipline. Always remember that success comes with experience and continuous learning. If you have any questions, feel free to ask!

❓ FAQ

Here are some frequently asked questions that new traders often have:

.jpg?alt=media&token=7e7f106e-ca8b-4cb2-9d13-2669607bd336/)

- What is the best strategy for beginners? Start with a simple strategy focusing on risk management and gradually build your knowledge.

- How much capital do I need to start trading? You can start with a small amount, but ensure you have enough to manage risks effectively.

- Is Forex trading the same as stock trading? While both involve trading assets, Forex focuses on currency pairs, and stocks involve shares of companies.